“Don’t sail out farther than you can row back.” This Danish saying is sound advice for anyone thinking of borrowing to buy a home, particularly now that interest rates are low and house prices are generally rising.

According to a paper1 for the Centre of Policy Development and University of Canberra, Australians have a tendency to be over-confident in our ability to repay loans. We also underestimate the likelihood of things potentially going wrong in our lives.

Have you ever heard yourself or someone else say “I’ll be able to repay my loan, provided I keep my job, don’t get sick and I’m not hit with any large unexpected bills”? Chances are you probably have. But things can and often do go wrong.

CAUSES OF MORTGAGE STRESS

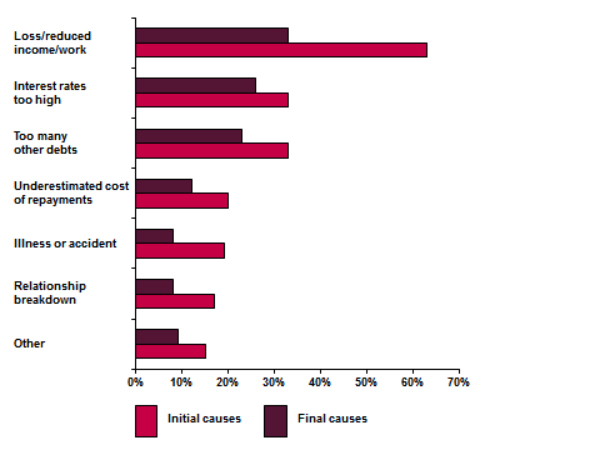

A study2 was completed for the Royal Melbourne Institute of Technology (RMIT), which looked at the specific triggers that have resulted in Australian households being unable to meet their mortgage repayments. Survey respondents were asked the initial causes and, if they changed, what the final causes were. They were also able to identify more than one cause. The graph below shows the results.

HOW TO REDUCE STRESS

Like most things in life, it’s difficult to make borrowing a stress-free exercise, but there are a few things you can do to reduce the angst.

1. Don’t borrow the maximum amount

Most financial institutions determine the maximum loan they will provide based on a multiple of your income and other factors. But if you borrow the maximum amount, you may find you are stretched from day one unless you are very disciplined with your budgeting.

2. Build up a buffer

It’s a good idea to hold (or build up) a cash reserve in a mortgage offset account to provide a buffer that can be drawn upon to meet your loan repayments if you become ill or are off work for other reasons.

3. Take out mortgage protection insurance

Many lenders offer insurance when you take out a home loan that covers the mortgage (often up to a specified amount and for a particular period of time) if you die, become disabled or your employment ends involuntarily.

4. Take out personal insurances

While mortgage protection insurance can provide peace of mind for a limited time frame, other types of insurances should be considered. These include:

· Income Protection Insurance which can replace up to 75% of your income if you are unable to work due to illness or injury. This can ensure you are able to continue meeting the majority of your living expenses, not just your loan repayments.

· Critical Illness Insurance which can help you service or pay off your loan and meet a range of expenses in the event you suffer a specified illness, such as cancer or a heart attack.

· Total and Permanent Disability Insurance which can help you service or pay off your loan and provide an ongoing income if you become totally and permanently disabled.

· Life Insurance which can be used to service or pay off your loan and provide your family with an ongoing income if you pass away.

5. Fix the interest rate

Fixing the interest rate on your home loan can provide protection against rising interest rates. The downside is there are often restrictions on making additional payments into a fixed rate loan, which would limit your capacity to build up a buffer. Many people find a combination of fixed and variable rate loans works best, as additional repayments can be made into the variable rate portion of the debt.

6. Don’t add fuel to the fire

Over 40% of the people who completed the RMIT survey responded to the initial difficulty in meeting mortgage repayments by using credit cards more often than they normally would. Using debt to service debt is very likely to compound the problem.

7. Seek advice

At the first sign of a problem, it’s essential to seek financial advice, as there may be a range of potentially viable options to explore. Better still, you may want to seek financial advice before you decide how much to borrow.

An adviser can help you assess your budget and determine your affordability level. They can help you to focus on other goals you may want to achieve in the short, medium and long term and the cash flow that may be required to meet them. They can also assess your insurance needs and advise you on a range of other financial matters.

To find out more, contact us today.

1. Source: Understanding human behaviour in financial decision making: Some insights from behavioural economics. Paper to accompany presentation to No Interest Loans Scheme Conference “Dignity in a Downturn” June 2009. Ian McAuley, Centre for Policy Development and University of Canberra.

2. Source: Mortgage default in Australia: nature, causes and social and economic Impacts. Authored by Mike Berry, Tony Dalton and Anitra Nelson for the Australian Housing and Urban Research Institute, RMIT Research Centre, March 2010.

Wealthness Pty Ltd t/as Better Financial Planning Australia will endeavour to update the website as needed. However, information can change without notice and Wealthness Pty Ltd t/as Better Financial Planning Australia does not guarantee the accuracy of information on the website, including information provided by third parties, at any time. Information in this publication is accurate as at October 2017 and subject to change without notice.

This information is of a general nature only and neither represents nor is intended to be specific advice on any particular matter. Infocus Securities Australia Pty Ltd strongly suggests that no person should act specifically on the basis of the information contained herein but should seek appropriate professional advice based upon their own personal circumstances. Although we consider the sources for this material reliable, no warranty is given and no liability is accepted for any statement or opinion or for any error or omission.

Wealthness Pty Ltd t/as Better Financial Planning Australia does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, Wealthness Pty Ltd t/as Better Financial Planning Australia and its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

Wealthness Pty Ltd (ACN 613 313 250) [t/a Better Financial Planning Australia] Corporate Authorised Representative of Infocus Securities Australia Pty Ltd ABN 47 097 797 049 AFSL Licence No. 236523. Source: MLCMARCH 7, 2018