A number of measures have been announced to support Australians and the economy in response to the Coronavirus.

We have put together some information to summarise the key measures and to assist you in understanding the help that could be available to you.

When will these announced measures be implemented?

The Government wishes to implement many of their stimulus measures as soon as possible and a package of Bills will be introduced into Parliament in the final Autumn sitting week (23 – 26 March 2020) as legislation needs to pass to give effect to these proposals. These Bills will provide more detail on the announced measures.

Outlined below is a summary of some of the key measures announced.

Superannuation

ACCESS TO SUPER SAVINGS

Access to superannuation savings will be broadened where you’re in financial distress because of the Coronavirus and meet certain eligibility conditions.|

If you’re eligible you’ll be able to access up to $10,000 before 30 June 2020 and an additional $10,000 from 1 July for approximately three months (depending on the timing of legislation).

To be eligible, you must meet one of the following conditions:

• you’re unemployed

• you’re eligible to receive Jobseeker Payment, Youth Allowance (jobseekers), Parenting Payment, Special Benefit or Farm Household Allowance

• on or after 1 January 2020, you were made redundant, your hours of work reduced by at least 20%, or if you’re a sole trader, your business was suspended or your turnover reduced by at least 20%.

Applications will be through MyGov and you’ll need to certify that you meet one of the above eligibility requirements. Once the ATO confirms you’re eligible, they will issue you and your super fund with a determination and the payment will be made to you. If you have a self-managed super fund, arrangements will differ.

Payments will be tax-free and amounts received will not impact Centrelink or DVA entitlements.

It is expected that claims can be made from mid-April.

INCOME STREAM DRAWDOWN RATES

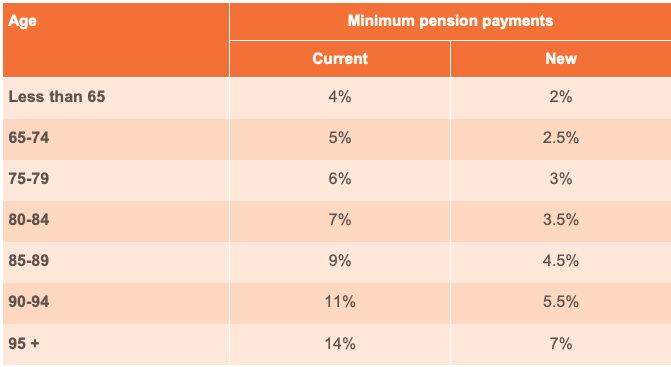

There will be a temporary reduction in the minimum annual amount that you’re required to withdraw from your super income stream. The reduction in the minimum drawdown rates will apply for the duration of this financial year and for the 202/21 financial year.

Business investment

SMALL BUSINESS LOANS – RELIEF PACKAGE

Australian banks will provide support to eligible small businesses by deferring loan payments for up to six months, where assistance is required as a result of COVID-19. The intention is for banks implement this as soon as possible.

CORONAVIRUS GUARANTEE SCHEME

The Coronavirus Guarantee Scheme will provide a Government guarantee of 50% of the value of new loans issued by eligible lenders to small and medium sized businesses. The intention of this measure is to increase access to loans by businesses impacted by the Coronavirus.

ADDITIONAL LUMP SUM PAYMENTS TO EMPLOYERS

Small and medium sized businesses and not-for-profit organisations that employ people will receive a payment of between $20,000 and $100,000 to assist with operating expenses.

The Government had previously announced payments to businesses linked to withholding tax for employees. This measure has been amended to double the amounts that eligible employers can receive. The amount of payment depends on whether the business is required to withhold tax on salary and wages for employees.

Where the employer is required to withhold tax on salary and wages, the employer will be entitled to an amount equal to 100% of the amount withheld (up to a maximum of $50,000). Those employers who are not required to withhold tax will receive a minimum payment of $10,000.

The payment will be tax free and received as a credit on the business’ activity statements by the ATO from 28 April 2020. The timing of the credit will vary depending on the required frequency of lodgement of activity statements (eg monthly or quarterly).

INSTANT ASSET WRITE-OFF

From 12 March 2020, the instant write-off threshold will increase from $30,000 to $150,000. It has also been broadened and will be available to businesses with an annual turnover of up to $500 million for the current financial year (an increase from $50 million). This applies to new or second-hand assets used or installed ready for use by 30 June 2020. The increased write-off threshold will apply on a per asset basis until 30 June 2020.

ACCELERATED DEPRECIATION

Accelerated depreciation of 50% will apply to eligible assets until 30 June 2021. Eligible assets are those acquired after the announcement and are used or installed ready for use by 30 June 2020. However, it does not apply to second-hand assets, building or other capital works deductible under separate tax provisions. This concession will be available to business with aggregated turnover of less than $500 million.

EMPLOYERS WITH APPRENTICES AND TRAINEES

Eligible employers who employ apprentices or trainees can apply for a subsidy of 50% of the employee’s wage. This applies for the period of 1 January – 30 September 2020. The maximum payment is $21,000 per apprentice or trainee.

If an employer is unable to retain an apprentice, the subsidy will be available to the new employer.

An eligible employer must have less than 20 full-time employees. The apprentice or trainee must be in employment with the business as at 1 March 2020. Other employers, regardless of size, and Group Training Organisations that re-engage eligible out-of-trade apprentices or trainees are also eligible for the subsidy.

Eligible employers can register for the subsidy from early April 2020 and final claims for payments lodged by 31 December 2020.

Social security

$750 CASH PAYMENTS

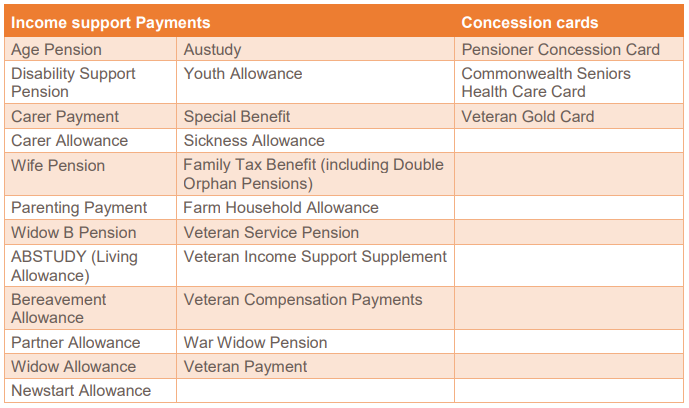

Two payments of $750 each will be paid to eligible income support recipients and concession card holders. The first tax-free payment will be available to eligible income support recipients as at 12 March 2020 and is expected to be automatically paid to eligible recipients from 31 March 2020. The second payment will be available to those who aren’t eligible for the Coronavirus supplement (see below) and will be automatically paid from 13 July 2020.

Eligibility for payment one

To be eligible, you must be residing in Australia and receiving one of the income support payments, or a holder of one of the concession cards listed in the table below. However, in relation to the first $750 payment you must also have been receiving an income support payment on 12 March 2020. If you had applied for an eligible payment before 12 March 2020 and are subsequently granted the payment, you will also be eligible for the one-off payment.

CORONAVIRUS SUPPLEMENT

The Coronavirus supplement of $550 per fortnight will be paid to new and existing recipients of:

• JobSeeker Payment

• Youth Allowance (Jobseeker)

• Parenting Payment

• Farm Household Allowance, and

• Special Benefit.

The supplement will be paid over the next six months and will be paid automatically with the person’s ordinary fortnightly entitlement. It will be paid from 27 April.

EXISTING SOCIAL SECURITY RECIPIENTS

If you’re already receiving a particular benefit or payment and your circumstances change due to COVID-19, your benefit may remain unchanged. However, a change in circumstances that is not a result of COVID-19 will be assessed under the ordinary rules, and may impact your entitlement. All changes should be reported to Centrelink or DVA.

• Recipients of Carer Payment who are impacted will not have their benefits changed.

• Child Care Subsidy: if your child cannot attend childcare as a result of COVID-19, but you’re still charged a fee from your childcare provider, you may still receive the subsidy for up to 42 days of absence. This applies also to non-COVID-19 related absences. If your activity hours change, you don’t need to update your activity tests where it is due to a requirement to self isolate, or if you’re on leave.

• Newstart or Jobseeker: Recipients with mutual obligations (for example Newstart or Jobseeker recipients who usually need to be actively looking for work, volunteering, or doing some paid work) will be provided flexible options to ensure your safety. This may apply where you’re unable to satisfy these requirements because you’re self-isolating, or you’re a primary carer, caring for a child whose school has closed, or a disabled adult whose day service closes. You may receive an exemption from this requirement without a need for medical evidence.

• Youth Allowance (student): Activity requirements for study will be amended. This means that if you’re a student and you’re unable to attend studies due to the virus, you may be exempt from meeting this requirement.

• Students and trainees: If you’re self isolating at home or your education provider closes or reduces your study load, your payment won’t change. You must remain enrolled in study and have a plan to return and must tell Centrelink if this doesn’t apply to you.

APPLYING FOR A BENEFIT

If you’re unable to work, are in isolation or hospital, or you need to care for children as a result of COVID-19, you may be eligible to apply for a payment.

If you apply for a social security benefit or concession card and your claim is related to COVID-19, some of the ordinary eligibility rules may be waived. Also, if you’re an employee, and you are diagnosed with COVID-19 or are in isolation, you may be eligible for an income support payment if you have no employer leave entitlements.

WAITING PERIODS AND ASSETS TESTING

The ordinary one week waiting period that applies to some payments will be waived when you’re claiming because you’re impacted by COVID-19.

The Liquid Assets Waiting Period (LAWP) will also be waived if you’re entitled to the Coronavirus Supplement. If you’ve already applied for a payment and are currently serving a LAWP, you won’t need to serve the remainder of the waiting period. This applies also if you’ve applied for a payment which is eligible for the Coronavirus Supplement.

The Income Maintenance Period and Compensation Preclusion Periods will continue to apply. The assets test will also not be applied when determining entitlement to JobSeeker Payment, Youth Allowance (Jobseeker) and Parenting Payment for six months. The income test will continue to apply and may reduce the amount of the payment you’re eligible for.

To access these measures, recipients of JobSeeker Allowance and Youth Allowance (Jobseeker) cannot be receiving employer benefits (such as sick leave or annual leave payments) or income protection payments at the same time.

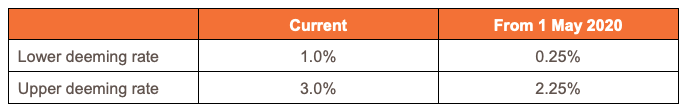

REDUCTION IN DEEMING RATES

A further reduction in deeming rates was announced on 22 March. The deeming rates will reduce as follows:

The deeming thresholds are unchanged at $51,800 (single) and $86,200 (couple) which are generally indexed on 1 July each year. The rates will take effect from 1 May 2020, and any additional entitlement will be paid from 1 May 2020.

FASTER CLAIMS PROCESS

New applicants are being encouraged to claim online where possible to ensure claims are processed as fast as possible. If this isn’t an option, claims can be made over the phone. To support this process, some temporary changes are also being made to identification requirements and other evidence which is generally required to process a claim.

Other measures

Additional measures announced include:

• Support for regions and communities impacted by the virus with reliance on tourism, agriculture and education

• Administrative relief provided by the ATO for certain tax obligations, such as lodging tax returns and activity statements, which will be assessed based on individual circumstances, and

• Comprehensive health package of $2.4 billion.

You may wish to contact the ATOs Emergency Support Infoline on 1800 806 218 or COVID-19@taxissues@ato.gov.au.

NEXT STEPS

To find out more about these are any other issues or concerns you may have, we recommend you contact us today.

Wealthness Pty Ltd ABN 13 231 248 112 [t/a Better Financial Planning Australia] is a Corporate Authorised Representative of Infocus Securities Australia Pty Ltd ABN 47 097 797 049 AFSL No. 236523. It is important to be aware that Better Financial Planning Australia is not authorised by Infocus to provide advice relating to credit services or property advice. Infocus is not responsible for any advice outside of the scope of this authorisation and should you wish to act on any of this general information, please first seek professional financial advice.

Wealthness Pty Ltd t/as Better Financial Planning Australia will endeavour to update the website as needed. However, information can change without notice and Wealthness Pty Ltd t/as Better Financial Planning Australia does not guarantee the accuracy of information on the website, including information provided by third parties, at any time.

This information is of a general nature only and neither represents nor is intended to be specific advice on any particular matter. Infocus Securities Australia Pty Ltd strongly suggests that no person should act specifically on the basis of the information contained herein but should seek appropriate professional advice based upon their own personal circumstances. Although we consider the sources for this material reliable, no warranty is given and no liability is accepted for any statement or opinion or for any error or omission.

Wealthness Pty Ltd t/as Better Financial Planning Australia does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, Wealthness Pty Ltd t/as Better Financial Planning Australia and its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

Wealthness Pty Ltd (ACN 613 313 250) [t/a Better Financial Planning Australia] Corporate Authorised Representative of Infocus Securities Australia Pty Ltd ABN 47 097 797 049 AFSL Licence No. 236523.

Source: MLC